Der Fuhrer iz Movin' On Up!

Haider 'drunk' in fatal car crash

Haider 'drunk' in fatal car crashDemise of Der Drunken Demon has DeWinter Depressed

Naturally!

Marx "Das Kapital" fashionable again among young Germans

Don't Wanna go Kaboom Kaboom.....

Kurdish Jews recall a paradise lost

Passengers overcome Turkish plane hijacker

Flying Dutchmen Consciously Sought to Infect People With AIDS

The Greeks Get Their Piece On

The Greeks Get Their Piece On"The EU regularly turns a crisis into an opportunity to extend its own role," their defence spokesman Geoffrey Van Orden said

Naturally!

BBC: Media should treat Islam more sensitively than Christianity

The office of International Mideast envoy Tony Blair says the Gaza Strip's banks are on the verge of collapse

AHEM

Condi pushes investments in PA

Condi pushes investments in PA Bahrain Islamic Bank profit up 84 per cent

CIMB Islamic is the world's top arranger of sharia bonds

YESTERDAY: CIMB Islamic Bank has launched FXOP-i, a foreign exchange instrument with syariah-compliant option features which allows customers to hedge their foreign exchange (forex) risk.

The foreign exchange (currency or forex or FX) market refers to the market for currencies. Transactions in this market typically involve one party purchasing a quantity of one currency in exchange for paying a quantity of another. The FX market is the largest and most liquid financial market in the world, and includes trading between large banks, central banks, currency speculators, corporations, governments, and other institutions. The average daily volume in the global forex and related markets is continously growing and was last reported to be over US$ 4 trillion in April 2007 by the Bank for International Settlement.

I wonder what the "pressure" was:

I wonder what the "pressure" was:"We must restore confidence in our financial system," Paulson said. "The needs of our economy require that our financial institutions not take this new capital to hoard it, but to deploy it."

While the name of the nine banks weren't announced at this morning's press conference, they are widely assumed to be Citigroup, Goldman Sachs, Wells Fargo, JPMorgan Chase, Bank of America, Merrill Lynch (which was recently bought by BofA0, Morgan Stanley, State Street and Bank of New York Mellon.

"These are healthy institutions, and they have taken this step for the good of the U.S. economy," Paulson said.

According to the Wall Street Journal, "some of the big banks were unhappy about the government taking equity stakes, but acquiesced under pressure from Treasury Secretary Henry Paulson in a meeting Monday."

2007: Currency manipulation, protectionism, Henry Paulson and the Bank of Japan

2007: Currency manipulation, protectionism, Henry Paulson and the Bank of Japan

2007: Paulson re-activates secretive support team to prevent markets meltdown

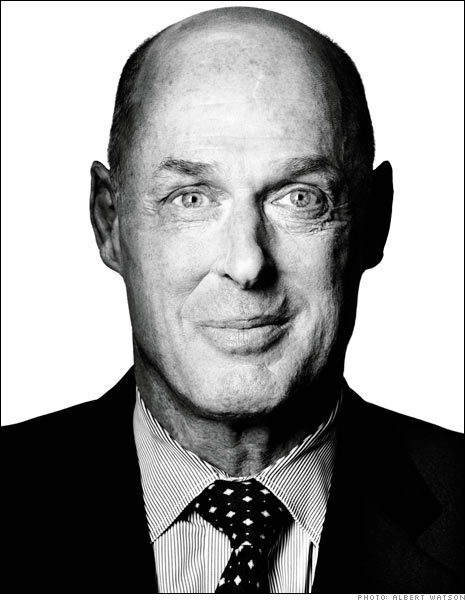

Hank Paulson, the market-wise Treasury Secretary who built a $700m fortune at Goldman Sachs, is re-activating the 'plunge protection team' (PPT), a shadowy body with powers to support stock index, currency, and credit futures in a crash.

Otherwise known as the working group on financial markets, it was created by Ronald Reagan to prevent a repeat of the Wall Street meltdown in October 1987 .

Mr Paulson says the group had been allowed to languish over the boom years. Henceforth, it will have a command centre at the US Treasury that will track global markets and serve as an operations base in the next crisis.

The top brass will meet every six weeks, combining the heads of Treasury, Federal Reserve, Securities and Exchange Commission (SEC), and key exchanges. Mr Paulson has asked the team to examine "systemic risk posed by hedge funds and derivatives, and the government's ability to respond to a financial crisis".

"We need to be vigilant and make sure we are thinking through all of the various risks and that we are being very careful here. Do we have enough liquidity in the system?" he said, fretting about the secrecy of the world's 8,000 unregulated hedge funds with $1.3trillion at their disposal.

The PPT was once the stuff of dark legends, its existence long denied. But ex-White House strategist George Stephanopoulos admits openly that it was used to support the markets in the Russia/LTCM crisis under Bill Clinton, and almost certainly again after the 9/11 terrorist attacks.

"They have an informal agreement among major banks to come in and start to buy stock if there appears to be a problem," he said.

"In 1998, there was the Long Term Capital crisis, a global currency crisis. At the guidance of the Fed, all of the banks got together and propped up the currency markets. And they have plans in place to consider that if the stock markets start to fall," he said. The only question is whether it uses taxpayer money to bail out investors directly, or merely co-ordinates action by Wall Street banks as in 1929. The level of moral hazard is subtly different.

[SNIP]

US dollar set to be major casualty of Hank Paulson's bailout

US dollar set to be major casualty of Hank Paulson's bailoutThe monetary union will entail the creation of a central bank to issue the single currency

Blankfein's $70 Million Would Survive Paulson's Rules

Big Brother in Britain

U.S. and Iraqi negotiators have agreed on a draft security pact that would govern the presence of American troops in Iraq after January, Bush administration officials say

The Afghan government has told the UN Security Council that the former Taliban rulers have become a threat to the country seven yearster they were toppled from power

MEANTIME......

Afghanistan seeks Saudi help to talk with Taliban

Afghanistan seeks Saudi help to talk with TalibanKarzai offers Taliban government office

Taliban vows more suicide attacks from women

"Middle East" to be replaced by "World of Islam"

Obama ad space now in video games

Obama ad space now in video games Candidates positions exactly the same re: immigration

Obamanable SnowJobsters Responds to Jesse Jackson's Comments on ‘Zionists’

Traffic ~ John BarleyCorn Must Die

They've hired men with the scythes so sharp,

To cut him off at the knee,

They've rolled him and tied him by the way,

Serving him most barbarously

They've hired men with the sharp pitchforks,

Who pricked him to the heart,

And the loader, he has served him worse than that,

For he's bound him to the cart

No comments:

Post a Comment